Amazing discounts with a Small Business Tax Software coupon or deals. Enjoy Business Tax Preparation software for less. Every dollar matters if you own a small business, especially regarding small business taxes. Whether your business is a partnership, LLC or corporation.

Small business tax software helps business owners prepare and file their business taxes. It can assist with tasks such as calculating and paying taxes, tracking expenses, and generating tax reports.

Many small business tax software options are available, and they vary in terms of features and pricing. Some common features of small business tax software include:

- Support for multiple tax forms and schedules

- Automatic calculations of taxes owed

- Import of financial data from accounting software

- Generation of tax reports and documents

- Integration with payroll and invoicing software

When choosing small business tax software, it’s important to consider your business’s specific needs and the features most important to you. Some software may be more suitable for certain businesses, such as freelancers, sole proprietorships, or partnerships. It’s also a good idea to compare the costs and features of different software options to find the one that offers the best value for your business.

Without good tax software, you could miss important tax credits and deductions that could save your business money in the long run. With the right tax program, you can also avoid costly tax errors.

Which tax software is best for small businesses?

Small Business Taxes are confusing enough without the additional stress of figuring out which tax software is the best tax software.

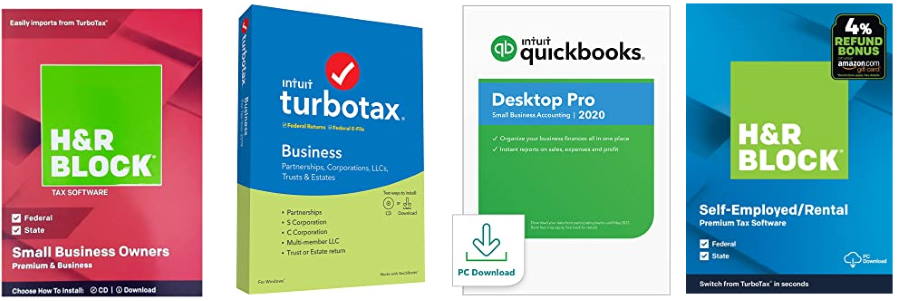

- TurboTax Business: Best UI but pricy.

- H&R Block: Best for complex business.

- Liberty Tax: Best for beginners.

- eFile.com: Best for small business.

- FreeTaxUSA: Best budget option.

- TaxAct Business: Cheap but not user-friendly.

What is the cheapest tax service?

As a general rule, the prices of tax professionals or accountants increase as your financial situation, and your tax return become more complex.

You should expect to pay an average of $200-$300 range if you want to itemize your deductions on your tax return.

If your tax situation isn’t very complicated, you can save money by purchasing online tax preparation software instead.

If your 2024 tax situation is very simple and basic, you can have your return prepared and filed for free, subject to some income limits.

What is the difference between 1065 and 1120s?

If you are a sole proprietor, you report your income and expenses on a Schedule C attached to your federal Form 1040 tax return when it is filed.

If you are a corporation or a partnership, you file a Form 1120 or a Form 1065 tax return.

How much does it cost to file taxes for a small business?

No matter how small your business is, you must file taxes. But, your small business tax preparation cost can be more expensive than you might think.

You can use accounting software (recordkeeping) to record your business transactions.

The more organized your bookkeeping is, the less time it takes to file your taxes.

Many accountants charge you per hour. If your accountant spends less time organizing your records, your bill could be the lowest.

Average small business tax preparation cost may vary depending on your region, industry, and business size:

- Form 1040 Schedule C (business)

- Form 1065 (partnership)

- Form 1120 (corporation)

- Form 1120S (S corporation)

- Form 1041 (fiduciary)

- Form 990 (tax exempt)

- Form 940 (Federal unemployment)

- Schedule D (gains and losses)

What is the cheapest business tax preparation software?

The cheapest business tax preparation software will depend on the specific needs of your business and the features you require. Here are a few options to consider if you’re looking for low-cost business tax preparation software:

- Free software: Some software companies offer free versions of their business tax preparation software for basic tax situations. These versions may have limited features and may not be suitable for businesses with more complex tax situations.

- Cloud-based software: Cloud-based software is generally more affordable than desktop software because it is subscription-based, and users only pay for the features and services they use. Some cloud-based business tax preparation software options offer new users free trials or discounted pricing.

- Self-service software: Self-service software allows users to prepare and file their own taxes with minimal support. These programs are generally less expensive than software that includes professional assistance, but they may not be suitable for businesses with more complex tax situations.

It’s important to compare the costs and features of different business tax preparation software options to find the one that best meets your needs. It would be best to consider factors such as ease of use, customer support, and integration with other business tools and systems.

Self-Employed Taxes for Independent Contractors

If you’re a freelancer or self-employed, you likely get paid as an independent contractor rather than an employee.

You could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (LLC), or adopt a corporate structure like c or s corp.

Employees usually get paid on a weekly, biweekly, or monthly basis. As an independent contractor, there is no consistent schedule.

These payments are not considered a salary or wages for tax purposes as no federal income taxes, Social Security taxes or Medicare taxes are taken out before you receive the money.

One must file a yearly tax return to pay federal income tax if your net earnings from self-employment are $400 or more.

Along with your IRS Form 1040, you’ll file a Schedule C to calculate your net income or loss for your small business.

You can file an IRS Schedule C-EZ form if you have less than $5,000 in small business expenses.

Independent Contractor’s Examples

Accountants, Freelance writers, Hairstylists, Lawn care providers, Electricians, Physicians, Dentists, Attorneys

Types of Small Business

The most common business entities are sole proprietorships, partnerships, limited liability companies (LLC), C or S corporations, and cooperatives.

- Sole proprietorship: Simplest form of business entity.

- Partnership: owned by two or more individuals.

- Limited liability company: LLCs are a hybrid structure that allows owners, partners, or shareholders to limit their liabilities.

- Corporation: Independent of its owners, it can sue, be sued, own and sell property, and sell the rights of ownership in the form of company stocks. There are several types of corporations, including C corporations, S corporations, B corporations, closed corporations and nonprofit corporations.

- Cooperative: co-op is owned by the same people it serves.

How to save on Small Business Tax Software?

Here are a few ways you can save money on small business tax software:

- Look for free or low-cost options: Some software companies offer free versions of their business tax preparation software for basic tax situations. These versions may have limited features, but they can be a good option for businesses with simple tax needs.

- Compare prices and features: There are many small business tax software options available, and they vary in terms of features and pricing. Compare the costs and features of different software options to find the one that offers the best value for your business.

- Consider cloud-based software: Cloud-based software is generally more affordable than desktop software because it is subscription-based and users only pay for the features and services they use. Some cloud-based business tax preparation software options offer new users free trials or discounted pricing.

- Use self-service software: Self-service software allows users to prepare and file their own taxes with minimal support. These programs are generally less expensive than software that includes professional assistance, but they may not be suitable for businesses with more complex tax situations.

- Take advantage of discounts and promotions: Software companies may offer promotional discounts or other special offers from time to time. Keep an eye out for these offers and take advantage of them when they are available.

- Consider tax preparation and filing services: In addition to software, you can also use tax preparation and filing services to help you prepare and file your business taxes. These services may be more expensive than software, but they can be a good option for businesses with complex tax situations or those that need professional assistance.

Tax Preparation

Free Tax Software

TurboTax Free Edition: Experience Zero-Cost Tax Filing

Which TurboTax version is best for you in 2024?

Tax Filing Season Dates

TurboTax vs. H&R Block

9 Ways You Can Save on Taxes This Year

TurboTax Desktop Deals

Small Business Tax Software

Free Student Tax Filing

e-file.com | E-file.com Premium Plus | Deluxe Plus Edition

TurboTax | TurboTax Deluxe | TurboTax Premium | TurboTax for Student

H&R Block

TaxSlayer

Jumpstart Your Taxes: Unbeatable Deals

Tax Season FAQs – Frequently Asked Questions

Early Bird Discounts: Take advantage of early tax filing offers

Jackson Hewitt

Taxact is the best business taxes software with a good price point for sole proprietorship, partnership, C corp, or S corp