COVID-19 continues to wreak havoc on American’s Lives.

Answers to your questions about the stimulus package, Who qualifies for household recovery rebates, including who gets the money and how much! Questions and answers FAQ’s.

On Friday March 27th 2020, President Donald Trump signed into law the largest economic relief bill in U.S. history, that includes direct cash payments for people across the country.

The much-needed financial help will soon be on the way for Americans eligible under the CARES Act. IRS link for Payment Updates

How much will I get?

Depends on your 2018 or 2019 tax return. (The IRS will either use a taxpayer’s 2018 return or their 2019 return)

On the 2018 returns, the adjusted gross income number is on Box 7 in a person’s 1040 form. On the 1040 form for the 2019 returns, adjusted gross income is found on Box 8b.

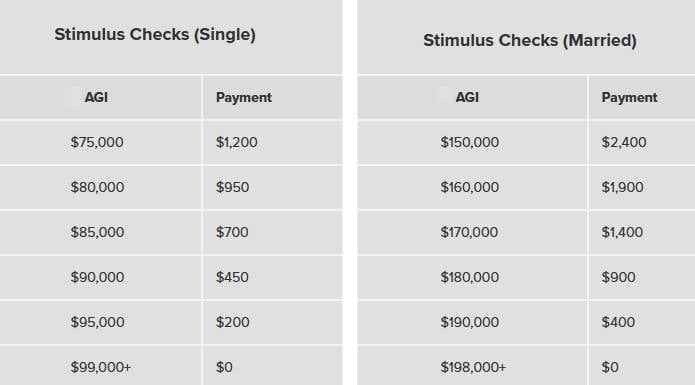

Single Tax Filers

Taxpayers making $75,000 and below will receive a $1,200 check.

Married Couples Couples who filed jointly

Married couples making $150,000 and below will receive $2,400.

Individuals and couples under this earnings cap would also receive $500 per child

Head of household

An individual who filed as “head of household” and earned $112,500 or less gets $1,200.

For every child in the household, you will receive an additional $500.

The checks phase out for incomes above $75,000 a year

If you made more than $75,000, your payment will be reduced by $5 for every $100 of income that exceeds the limits.

So if you made $80,000 in 2019, you will receive $950.

If you’re a family of four, you’ll be eligible for a maximum of $3,400.

Income Limit

The payment decreases to zero for an individual making $99,000 or more or a couple making $198,000 or more.

How will the Rebate Check Payment be made?

The IRS will transmit the payment via a direct deposit. It will use the bank-account information from the taxpayer’s 2018 or 2019 tax return.

Will green card holders get a stimulus check

Green card holders, in addition to citizens, qualify for the check

Is the stimulus check taxable ?

The money does not count as taxable income.

Is Social Security beneficiaries eligible for Coronavirus checks

Those receiving Social Security benefits will be eligible.

When is the stimulus money coming?

Treasury Secretary Steven Mnuchin said the stimulus checks will be sent out “within three weeks” to people for whom the IRS has information.

You don’t need to sign up or fill out a form to receive a payment if you’ve been working and paying taxes since 2018.

The payments will be automatic for people who have filed a tax return or gotten Social Security benefits recently.

How will the money be sent?

IRS will sent the money by direct deposit, if you’ve gotten a tax refund in the last two years.

If not, the IRS can mail a check to your “last known address” and it has 15 days to notify you of the method and amount of the payment. They’ll send a phone number and appropriate point of contact so you can tell them if you didn’t receive it.

If you’ve moved recently, it may be a good idea to notify the IRS as soon as possible.

I’m a college student. Do I get a check?

If your parents claim you as a dependent on their taxes, you’re ineligible. But if you’ve been filing taxes independently in recent years, you may qualify.

Do I have to pay the stimulus money back?

No. The money isn’t a loan, but a credit. You are not required to pay the government back.

I owe back taxes. Will the IRS grab my check?

No, your payment won’t be affected if you owe past due taxes to federal or state governments.

I’m behind on child support payments. Does that affect me?

Yes, that’s a problem. The IRS may reduce the amount you receive if you have past due child support payments that have been reported by states to the Treasury Department.

What is AGI adjusted gross income?

According to the IRS, AGI is defined as gross income minus adjustments to income.

Gross income refers to your:

|

Adjustments to that income include:

|

Coronavirus Stimulus Check Calculator: How Much Will I Get?

Trump signed the historic $2 trillion coronavirus economic rescue bill hours after the House of Representatives passed the legislation in a voice vote. Senators unanimously passed the measure.

In the United States, as small businesses shut down due to coronavirus crisis, millions of workers have already been laid off, leaving many to wonder how they’ll pay their bills.